Ever walk into a store or browse online and see wildly different prices for similar products? Understanding why those differences exist, particularly for products competing directly with yours, isn’t just curious; it’s absolutely crucial for your product’s success. Analyzing your competitors’ pricing strategies helps you position your product effectively. Like comparing prices at different stores to find the best deal, examining how your rivals price their offerings gives you vital insights into the market and how to set your own prices strategically. Without this understanding, your pricing decisions risk being misaligned with customer expectations and the competitive landscape.

The Price is Right: Understanding and Analyzing Competitive Pricing Strategies

Understanding the competitive landscape and the broader market is vital for informing product strategy and identifying opportunities. Competitive pricing analysis is a core part of this effort. It’s not just about knowing the price tag; it’s about dissecting the ‘why’ behind it. Are competitors pricing high to signal premium quality? Are they pricing low to capture market share? What value are they bundling at that price point?

Leveraging Frameworks to Understand the Competitive Pricing Landscape

Several product management frameworks provide structure for developing a robust product strategy, and many are invaluable for understanding the pricing context set by competitors.

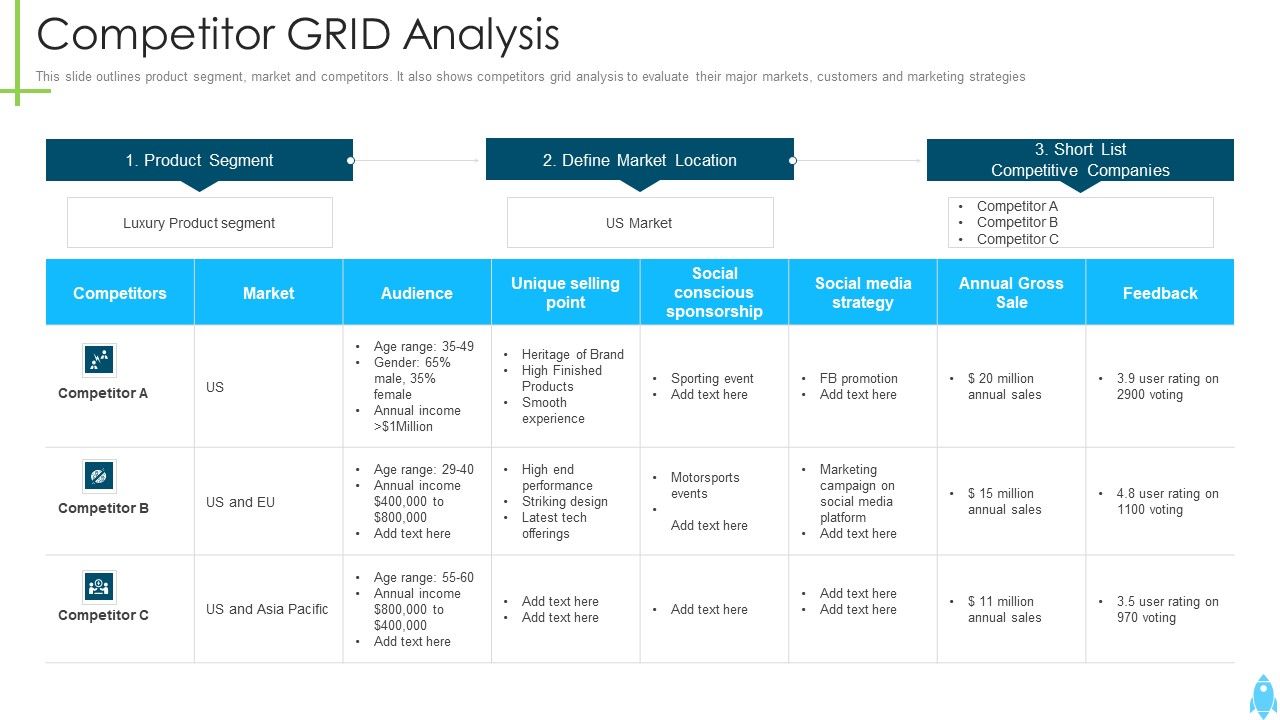

- Competitive Analysis Grid: A practical tool for this is developing a Competitive Analysis Grid. This allows for a structured, side-by-side comparison of competitors across key dimensions such as product features, market positioning, marketing strategies, and, importantly, pricing. Seeing competitor pricing listed alongside their offerings helps identify potential areas of competitive advantage or disadvantage. For instance, if a competitor with fewer features is priced higher, it might signal a different target market or value proposition that you need to understand. Conversely, if a competitor with similar features is priced significantly lower, it might suggest they have achieved greater operational efficiency.

Take a look at this reference image given below: [Although I generally prefer to create my own visual cues/references in my blogs, but sometimes I do use other sources & whenever such sources are used, I will promptly provide source links. Click here to goto the source of the below image]

Analyzing Competitor Pricing Strategies and Models

- Porter’s Five Forces: Porter’s Five Forces framework is a powerful tool for analyzing the competitive forces within an industry that shape its attractiveness and profitability. Understanding the intensity of these forces can shed light on the pricing environment. For example:

- Bargaining Power of Buyers: If buyers have high bargaining power, competitors may be forced to lower prices, influencing the general price levels in the industry.

- Intensity of Rivalry Among Existing Competitors: High rivalry often leads to price wars or competitive pricing pressure as companies contest for market share, directly impacting competitor pricing strategies. Analyzing these forces helps you understand the underlying pressures that may be driving your competitors’ pricing decisions.

Here’s a quick outline of all 5 forces (i.e., Porter’s Five Forces at a glance):

- Market Segmentation Analysis: Dividing a broad target market into smaller, more homogeneous groups with similar needs or characteristics allows for more targeted product development and marketing efforts. Competitors may employ different pricing strategies for different market segments. Analyzing their approach to specific segments can reveal opportunities or challenges for your own pricing strategy. Like tailoring clothes to different body types, market segmentation helps you create products and pricing for specific customer groups.

- Value Disciplines: This framework suggests companies gain competitive advantage by excelling in one of three areas: Operational Excellence, Product Leadership, or Customer Intimacy. Analyzing where your competitors focus helps you understand their likely pricing approach. A competitor focused on Operational Excellence might prioritize offering the lowest price. One focused on Product Leadership might charge a premium for innovative features. A competitor pursuing Customer Intimacy might tailor pricing based on specific customer relationships or bundled services. Understanding their discipline helps you anticipate their pricing moves and define your own value proposition and corresponding pricing strategy.

Analyzing Competitor Pricing Strategies and Models

Analyzing competitor pricing involves looking beyond just the list price. It includes examining discounts, pricing tiers, feature bundling, and contract terms. Like comparing prices at different stores, analyzing your competitors’ pricing helps you position your product effectively. This could involve understanding:

- Pricing Models: Are competitors using subscription models, one-time purchases, freemium tiers, or usage-based pricing? While the sources mention exploring different revenue models for our product, applying this lens to competitors helps understand how they monetize and how their pricing is structured.

- Pricing Tiers and Features: How do features correlate with different price points? What features are included in their basic versus premium plans? This analysis helps you determine if your feature set justifies your price point relative to competitors.

- Discounting and Promotions: Do competitors frequently offer discounts or run promotions? This can indicate pricing flexibility or pressure.

- Value Bundling: What services or support are included in the price? Understanding the total value package offered at a certain price is essential.

My two cents:

Could a Disruptive Pricing Strategy Give You a Significant Competitive Advantage?

Often, analyzing competitor pricing leads to strategies focused on matching or slightly undercutting rivals. But what if you completely redefined the pricing model or significantly altered the price point in a way that disrupts the market? Could a disruptive pricing strategy give you a significant competitive advantage?

Think of companies that introduced radically different pricing models, like the move from perpetual software licenses to SaaS subscriptions, or companies that offered a free tier where none existed before. Such moves, if aligned with a clear understanding of market needs and cost structure, can reshape customer expectations and force competitors to adapt, potentially creating a significant competitive moat. It requires deep market understanding, a clear value proposition, and often operational efficiency to support a lower price point, but the potential payoff in market share and brand perception can be substantial.

Synthesizing Analysis for Strategic Product Planning

Turning competitive pricing data into decisions is the goal. Like a detective piecing together clues to solve a mystery, you need to synthesize your analysis to inform your product strategy. This involves evaluating:

- How does competitor pricing influence customer price sensitivity in your market segments?

- Where are there gaps or opportunities in the market based on competitor pricing and feature sets?

- How can your product’s unique value proposition support a specific pricing strategy relative to competitors?

- Could a different pricing model or a disruptive price point be viable and advantageous for your product?

A holistic understanding of the market landscape, including competitor pricing strategies, is crucial for making informed decisions and revealing unexpected opportunities for your product.

Conclusion

Analyzing competitor pricing strategies is far more than just knowing what they charge. It’s about understanding the market forces at play, dissecting their value propositions, and identifying opportunities to position your own product effectively. By leveraging frameworks like the Competitive Analysis Grid, Porter’s Five Forces, Market Segmentation, and Value Disciplines, and by continuously monitoring competitor moves, product managers can make data-informed pricing decisions.

And sometimes, the biggest advantage comes not from following the pack, but from daring to redefine the rules with a disruptive pricing strategy. Mastering this analysis is key to ensuring your product’s price is indeed “right” for the market and your business goals.